Tulsa Bankruptcy Lawyer: How To Manage Creditor Negotiations In Bankruptcy

Tulsa Bankruptcy Lawyer: How To Manage Creditor Negotiations In Bankruptcy

Blog Article

Tulsa Bankruptcy Attorney: How To Manage Bankruptcy And Child Support

Table of ContentsTulsa Bankruptcy Lawyer: The Role Of Government Agencies In Bankruptcy CasesBankruptcy 101: A Guide By Tulsa Bankruptcy AttorneysTulsa, Ok Bankruptcy Attorney: Strategies For Managing Bankruptcy StressBankruptcy Lawyer Tulsa: The Challenges Of Filing Bankruptcy Without Legal Help

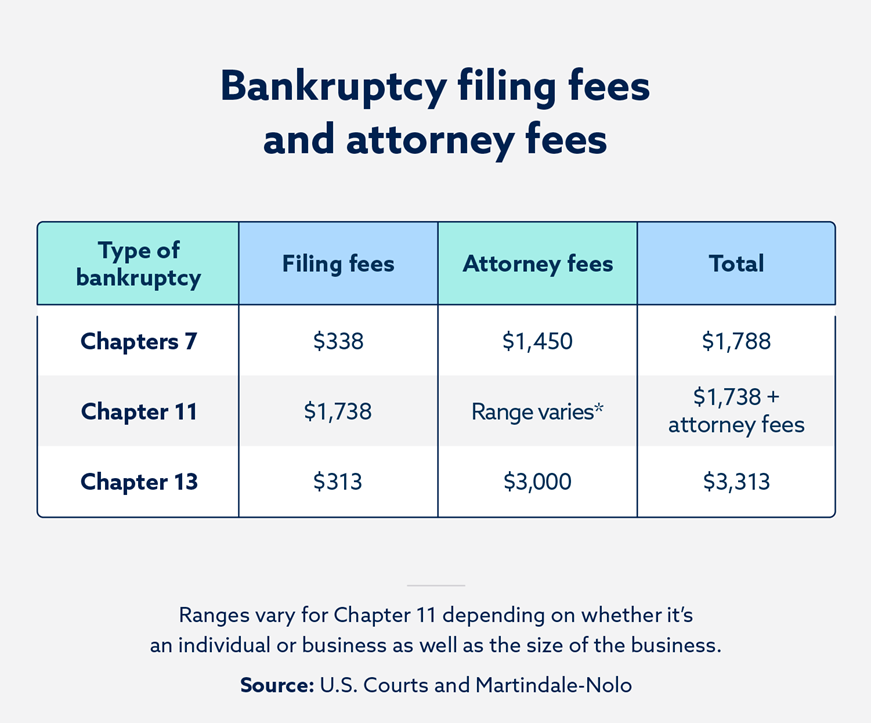

It can damage your credit for anywhere from 7-10 years as well as be a barrier towards obtaining security clearances. Nonetheless, if you can not fix your issues in less than five years, insolvency is a practical choice. Legal representative fees for insolvency vary depending upon which form you select, how complicated your situation is as well as where you are geographically. Tulsa bankruptcy attorney.Various other personal bankruptcy costs consist of a declaring fee ($338 for Phase 7; $313 for Chapter 13); and fees for credit rating counseling and monetary administration training courses, which both expense from $10 to $100.

You do not always need an attorney when submitting specific insolvency on your very own or "pro se," the term for representing yourself. If the case is straightforward sufficient, you can file for insolvency without aid. But many people profit from depiction. This post explains: when Phase 7 is also complicated to handle on your own why employing a Chapter 13 legal representative is constantly vital, as well as if you represent on your own, just how a personal bankruptcy application preparer can assist.

The general rule is the less complex your bankruptcy, the much better your possibilities are of finishing it on your own as well as receiving a personal bankruptcy discharge, the order erasing financial obligation. Your instance is most likely simple enough to deal with without an attorney if: However, also simple Chapter 7 cases need job. Plan on filling in extensive documentation, gathering monetary documents, researching insolvency as well as exception legislations, as well as following neighborhood guidelines and treatments.

How To File For Bankruptcy Without A Tulsa Bankruptcy Attorney

Right here are two circumstances that constantly call for depiction., you'll likely desire a legal representative.

If you make a mistake, the personal bankruptcy court can toss out your situation or sell properties you thought you might maintain. If you lose, you'll be stuck paying the financial obligation after personal bankruptcy.

If you make a mistake, the personal bankruptcy court can toss out your situation or sell properties you thought you might maintain. If you lose, you'll be stuck paying the financial obligation after personal bankruptcy. You might want to file Chapter 13 to capture up on mortgage debts so you can keep your house. Or you could desire to remove your bank loan, "cram down" or reduce a vehicle loan, or repay a financial obligation that won't disappear in insolvency over time, such as back taxes or assistance debts.

You might want to file Chapter 13 to capture up on mortgage debts so you can keep your house. Or you could desire to remove your bank loan, "cram down" or reduce a vehicle loan, or repay a financial obligation that won't disappear in insolvency over time, such as back taxes or assistance debts.Numerous individuals recognize the lawful charges required to work with a bankruptcy legal representative are fairly affordable once they understand exactly how they can profit from a bankruptcy lawyer's help. In many situations, a personal bankruptcy lawyer can promptly identify issues you may not identify. Some individuals apply for personal bankruptcy due to the fact that they do not comprehend their alternatives.

Bankruptcy Attorney Tulsa: The Process Of Creditor Claims In Bankruptcy

For a lot of consumers, the rational choices are Phase 7 as well as Chapter 13 bankruptcy. bankruptcy lawyer Tulsa. Phase 7 can be the means to go if you have you can try here reduced income and no assets.

Staying clear of paperwork pitfalls can be problematic even if you pick the proper chapter. Right here prevail concerns insolvency legal representatives can stop. Bankruptcy is form-driven. You'll have to complete an extensive government packet, and, in many cases, your court will also have neighborhood kinds. Several self-represented insolvency debtors don't submit all of the required bankruptcy records, and also their situation gets dismissed.

You Click This Link do not shed every little thing in insolvency, yet keeping residential property relies on recognizing just how residential or commercial property exemptions job. If you stand to lose useful residential or commercial property like your home, automobile, or various other residential or commercial property you care around, a lawyer may be well worth the cash. In Chapters 7 and 13, bankruptcy filers need to receive credit rating counseling from an approved company before filing for insolvency as well as finish a economic monitoring program on trial provides a discharge.

Not all bankruptcy instances continue smoothly, as well as other, much more complicated issues can develop. Several self-represented filers: don't understand the value of motions and also foe activities can't properly defend against an activity looking for to refute discharge, and have a challenging time complying with complex bankruptcy treatments.

Tulsa, Ok Bankruptcy Attorney: Life After Bankruptcy – A Fresh Start

Or something else might crop up. The bottom line is that an attorney is necessary when you locate on your own on the receiving end of a movement or legal action. If you make a decision to declare bankruptcy by yourself, figure out what solutions are readily available in your area for pro se filers.

, from sales brochures defining low-cost or cost-free solutions to thorough information about insolvency. Look for a bankruptcy publication that highlights situations requiring an attorney.

You have to precisely submit lots of types, research the regulation, and also attend hearings. If you understand personal bankruptcy legislation but would such as aid completing the forms (the standard personal bankruptcy petition is about 50 web pages long), you may consider hiring an insolvency request preparer. A bankruptcy application preparer is anyone or company, other than a legal representative or somebody who helps a legal representative, that charges a fee to prepare personal bankruptcy papers.

Because insolvency request preparers are not attorneys, they can not provide lawful advice or represent you in insolvency court. Particularly, they can't: inform you which kind of bankruptcy to file tell you not to note specific financial obligations tell you not to list certain properties, or inform you what home to excluded.

Because insolvency request preparers are not attorneys, they can not provide lawful advice or represent you in insolvency court. Particularly, they can't: inform you which kind of bankruptcy to file tell you not to note specific financial obligations tell you not to list certain properties, or inform you what home to excluded.Report this page